Importance of Attitudinal Loyalty

The Most Profitable Way to Generate Profits

Three Ways of Increasing Profits

The primary goal of a business is to generate profits. A business that achieves this goal has the next challenge: how to sustain and grow profitability of the operations? If you are products and services business, you have 3 ways to generate more profit:

Sell the same amount of product at the same price but at a lower cost.

Sell the same thing to more customers

Sell more your existing customers

Any organization will attempt various flavors of all three of these approaches, supervising operations to look for cost savings, generating and chasing leads to find new customers, and servicing your existing customers to keep them happy, looking for renewals and upsell opportunities.

The question for business leaders with a limited amount of resources and focus is which activities are more valuable to the business. In other words, which approach for increasing profits is more profitable?

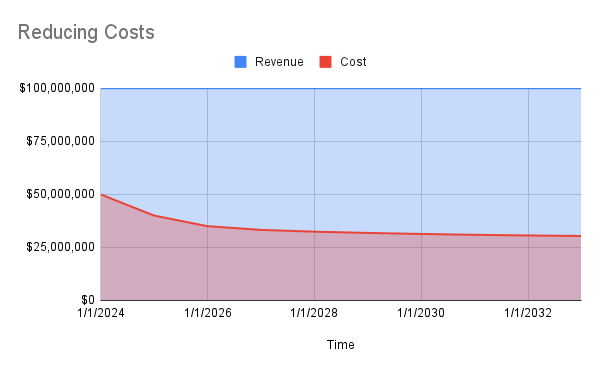

Reducing costs:

Selling the same thing, at the same price but at less cost is a very natural way to increase profits. The following is a variety of ways of doing this:

Reduce raw material costs. This can be done by negotiating better prices with existing suppliers. However, unless your suppliers have been gouging you in the past, to get a better deal, you may have to give your supplier something in return like better payment terms or purchasing more inventory sooner than you need it. You could also move to suppliers offering you discounts to win or maintain your business. This trick will need to be repeated on an annual basis to maintain your savings. You can also look for ways to use lower-cost materials that have equivalent properties. Finally, you can look for ways of using less material in your product which ties into reducing waste (see below). For SaaS businesses, this comes down to tightly managing your cloud costs both in quantity of services used but also through creative sourcing.

Reduce labor costs. This can be done by automating some of the product development and production processes. There may also be opportunities to find process efficiency, eliminating steps that were introduced for historic reasons but no longer are tuned to the current situation. Finally, it may be possible to outsource some of the development and production to a lower-cost region or country.

Reduce energy costs. This can be done by using more efficient machinery, making sure that equipment is properly maintained, and using natural light and ventilation whenever possible. In computing, newer processors are not only more powerful, requiring fewer to do the same work, but also may consume less energy individually. Moreover, if your systems are using less energy, they are also generating less heat which directly translates into lower air conditioning costs for your machine rooms and offices.

Reduce waste. This can be done by implementing lean manufacturing principles. Studying your scrap pile can inform where excess material and inventory is going. Quality controls on suppliers and working with them as partners can potentially reduce the amount of wasted. Understanding whether the scrap is actually valuable to use in production elsewhere or resell to someone can defray some of the costs. Finally, redesigning the product or manufacturing to reduce or eliminate the waste stream adds to possible savings.

Reduce overhead costs. This can be done by negotiating better deals on rent, insurance, and other overhead expenses. Some businesses are able to function successfully by reducing or eliminating office space, going virtual. Beyond the savings on rent, saving the cost of securing and powering office space is also a way of gaining a return. Reducing travel, working with customers and team members through web conferencing and online collaboration applications can be as effective as in-person meetings.

As you might understand, reducing costs is a continuous effort with the most significant gains coming early and with less effort. As you iterate, looking for additional savings, there is a risk that reducing costs too far, reduces the quality of your product and services to the point of having problematic long-term effects on revenue. For these reasons, reducing costs is considered the least profitable way of generating profit.

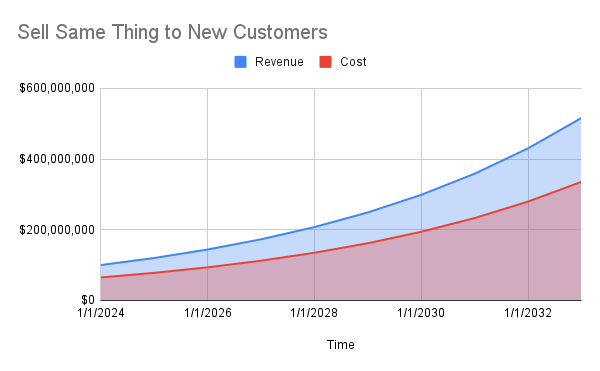

Selling to New Customers

So you’ve got your business rolling. You have a profitable product or service you are selling at volume. A natural goal is to find more customers and markets to sell to your existing offering. Here are the ways of getting there:

Up your lead generation: Getting your name out there is a multi-front attack. Generating positive awareness today begins on your website, tuned using Search Engine Optimization (SEO) and A/B testing (routing traffic to alternative versions of your web property to see what content is more effective) your traffic. Creating engagement through social media is the next most cost-effective place to put your money. PR firms can help get placement in trade articles, guide search term spending and ad placements. Trade expos can give you access to customers and channel partners.

Qualifying leads: Sales reps need to follow-up on leads. This can be optimized through sales operations that begin the processing of the sales funnel with inside-sales reps that qualify leads before handing strong opportunities over to direct sales reps to work the order.

Closing new opportunities: For new customers, sales will often have to work the opportunity through an RFP and evaluation process with the prospect. This may involve understanding the customer’s goals and demonstrate how the product or services address the need. There may be a formal proof-of-concept process, with support involved. Often, there will need to be incentives or special discounts to get a new prospect over decision hurdles and selling the purchase internally.

For these reasons, you can see there are significant costs involved to reap the rewards of adding new customers and breaking into new markets.

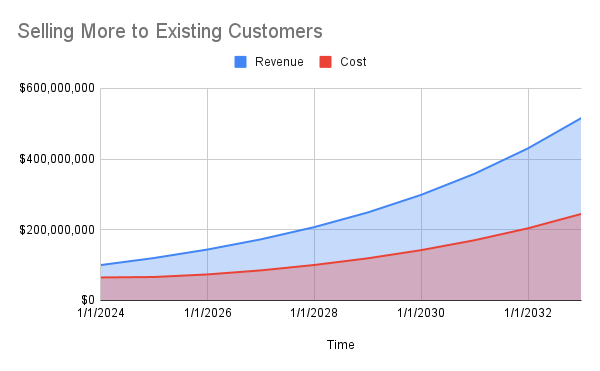

Selling More to Existing Customers

So you’ve got a list of existing customers. There is a certain amount of revenue you’ve achieved from them. Reselling to these customers, renewing subscriptions, et cetera should be the first goal. There is an opportunity to add additional profits from these existing customers with a few key programs:

Upsell and cross-sell. This is a classic way to generate more sales from existing customers. Upselling means selling them a more expensive product or service, and cross-selling means selling them complementary products or services. For example, a company that sells software could upsell customers to a more expensive plan with more features, or cross-sell them a subscription to a training course.

Get customer feedback. Customer feedback is essential for improving your products and services. It can also help you identify new opportunities to upsell and cross-sell. You can collect customer feedback through surveys, interviews, or focus groups.

Personalize the customer experience. The more you know about your customers, the better you can personalize their experience. This means understanding their needs, interests, and preferences. You can use this information to send them targeted marketing messages, offer them customized products or services, or simply make them feel like they're valued.

Make it easy to do business with you. The easier it is for customers to do business with you, the more likely they are to stay with you. This means having a clear and easy-to-use website, offering convenient payment options, and providing excellent customer service.

Most Profitable Profits

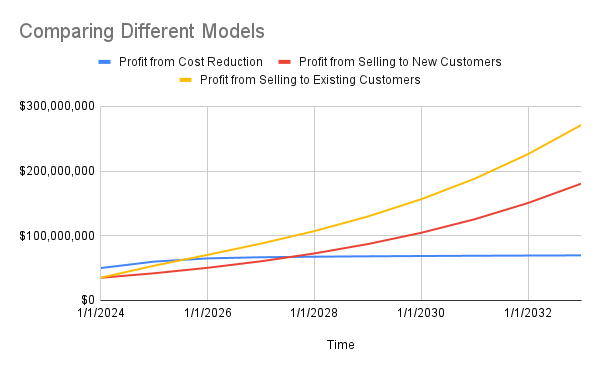

Each of the above approaches can generate more profits for the organization. The real question is which approach has the highest return for the level of effort the organization puts into it. In practice, though organizations will put energy into each one of these efforts, the value of the resources and mental energy shakes out as follows:

Selling more to existing customers is the most profitable way of generating profits

Selling to more customers is the next most profitable way of generating profits

Reducing cost is the least profitable way of generating profits

To better understand why this is so, let’s do a thought experiment of each of these examples with a the following fictitious company:

Imagine you have a company, Widge Inc, that is currently selling 1,000,000 widgets per year. Each widget sells at an average price of $100 per widget but only costs you $50 per widget to produce and deliver. This leads you to a current situation of generating $50,000,000 of profit from operations on $100,000,000 of total revenue.

In the above example, by reducing costs by 20% (i.e., $50 per widget to $40 per widget), can lead to an extra $10,000,000 of profits to your bottom line immediately. This sounds like a lot but essentially the total opportunity available is theoretically $50 (i.e., 100% of the cost). This is impossible because if you reduce the costs too far, you are no longer producing something of value. In truth, it will take significantly more effort to generate subsequent percent-points of savings. Having a focus on cost savings as part of operations is necessary to keep from wasting money. However, as a way of growing profits, this approach yields limited results and is often referred to as a “race to the bottom” because there is only so far you can go before you run out of opportunity.

If we increase sales by 20%, we get an additional $20,000,000 in revenue, that generates $10,000,000 in more profit. Moreover, the structures in marketing and sales operations should allow you to replicate this growth the following year generating an additional $22M in new customers sales and $11M in new profits on top of the $60M in profit gained by replicating sales from the previous year. In this way, we have a potential compounding effect from these investments. However, each transaction comes with these significant costs in marketing and sales, including discounts and other incentives needed to close this first transaction.

If we increase sales to existing customers by 20%, there isn’t the marketing spend, there isn’t a pre-sales evaluation and, hopefully, you already understand their needs. Expanding footprint, upselling and even raising prices are all possible if the conditions are right, the increase in profit comes at a significantly less cost.

The critical condition for this to happen effectively is putting the investments in to get to attitudinal loyalty. If you achieve this with your customer, the profitability impact becomes significant.

Attitudinal Loyalty

Executives sometimes simply focus on renewal rates as their measure of loyalty. This is just behavior loyalty. It certainly is a symptom of attitudinally loyal customers but it can be confused with customers who find the transition costs to other alternatives to be higher than just renewing or replacing aging inventory. A behaviorally loyal customer might renew or repurchase but they may make you pay for their loyalty in obvious and non-obvious ways. They may resist expansion. They require deep discounts on new features or products. They may escalate issues more frequently.

On the other hand, attitudinally loyal customers are those customers who see you as a strategic partner. Their renewals and repurchases are friction free. They consult with you up front to discuss future needs and expansions. They may include you in their budgetary planning. They are ready to be upsold.

Impact of Attitudinal Loyalty

When you achieve attitudinal loyalty, you get three kinds of returns:

Lower cost of sales

Referenceability

Market Insights

Think of brands that you have a high affinity to. It could be your cell phone manufacturer. It could be an auto manufacturer. It could be your favorite local coffee shop. Think of how this affinity not only makes you return to purchase more products, but also the personal pride you feel in your ownership and how you are quick to reference them when the topic comes up.

A tangible example of this happened when we were selling complex, high-availability systems to the financial services industry. These systems took a significant amount of effort to purchase, install and support. The behaviorally loyal customers renewed service contracts, but they complained, filed lots of escalations, dragged their feet and demanded steep discounts on service renewals. In many cases, they were strategizing around when they could remove us from their operations but hadn’t yet reached that point. We got repeat business but in their hearts, they were frustrated with their purchases.

Then there were a set of customers that had true attitudinal loyalty. Not only were they renewing promptly just by replying to our invoices, but also, they readily added more configurations, brought us into new areas within their organizations and added on capabilities when we made them available. After a couple of years of experience with this, we were able to record a ten-fold difference in profitability between these two sets of customers. We ended up investigating how we could have two dramatically different loyalty outcomes and found that these customers had stronger people on the sales and service teams. This told us the technology of the product was fine, but we had to make the whole experience more consistent with more automated installation processes, supervision of sales processes, training of service personnel and validation of deployments.

The overall effect of these changes to the business were dramatic, making this product line the most profitable software business in the company.

Referenceability

As important to lower cost of sales, attitudinally loyal customers are eager references for you. Having a list of customers who are willing to share their experiences with your prospects is incredibly helpful, demonstrating to prospects that you have customers who are willingly putting time into helping you grow the business. Prospects appreciate being able to talk to peers in their industry to get a somewhat independent insight into your products and services.

The best references are the ones you are unaware of. These are the references where people freely share their good experiences with their network without your involvement. This can happen at professional gatherings, trade shows, online forums or even cocktail parties. These unsolicited testimonials are golden and can take significant cost and friction out of new business in ways you may not be able to track directly, but have tangible impacts to your sales growth and bottom line.

This is why Net-Promoter Scores (NPS) is an important measure in addition to renewal or repurchasing rates. Measuring NPS accurately is merely a start.

Market Insight

A final benefit of getting your customers to be attitudinally loyal is that these kinds of customers are willing to confide in you, responding to surveys and more readily participating in focus groups and feedback sessions. These customers are willing to give you their perspectives because they are in your corner, they feel better about their affiliation with you and want you to succeed. Moreover, you have built trust with them (see Credibility Bank article), that they have confidence that you will do something with this insight that will make their lives better in the future.

The implication is that you have an opportunity to harvest market insight from these customers that your competitors don’t have access to.

Summary

Though it is important to manage costs and add more customers, prioritizing customer satisfaction and loyalty can have a dramatic impact on your business. Your results may vary but the impact of successfully achieving attitudinal loyalty with customers will be tangible and significant.

In my next article, I’ll outline how you can get to this differentiated level of loyalty.

Some Good Reading On the Topic

Reinartz, W. J. and V. Kumar, “The Impact of Customer Relationship Characteristics on Profitable Lifetime Duration,” Journal of Marketing 67, no. 1 (2003): 77–96.

Reichheld, F., Loyalty Rules! How Leaders Build Lasting Relationships, Harvard Business Review Press, 2001.